Table of Contents

Employee Withholding Form – As an employee, it is important to understand the process of withholding taxes from your paycheck. The Employee Withholding Form is used by employers to figure out how much they should withhold from each employee’s paycheck for federal, state, and local taxes. This form helps employers accurately calculate the amount of money that needs to be withheld from an employee’s wages. It also ensures that employees are being subjected to the correct amount of tax withholding so that they do not owe any money during tax season.

As an employer, it’s important to understand your tax withholding obligations. One of the key forms that you need to be familiar with is the Employee Withholding Form. This form is used to determine the amount of federal income tax that should be withheld from an employee’s paycheck. In this article, we’ll take a closer look at the Employee Withholding Form and what you need to know to stay compliant.

What is Form W-4?

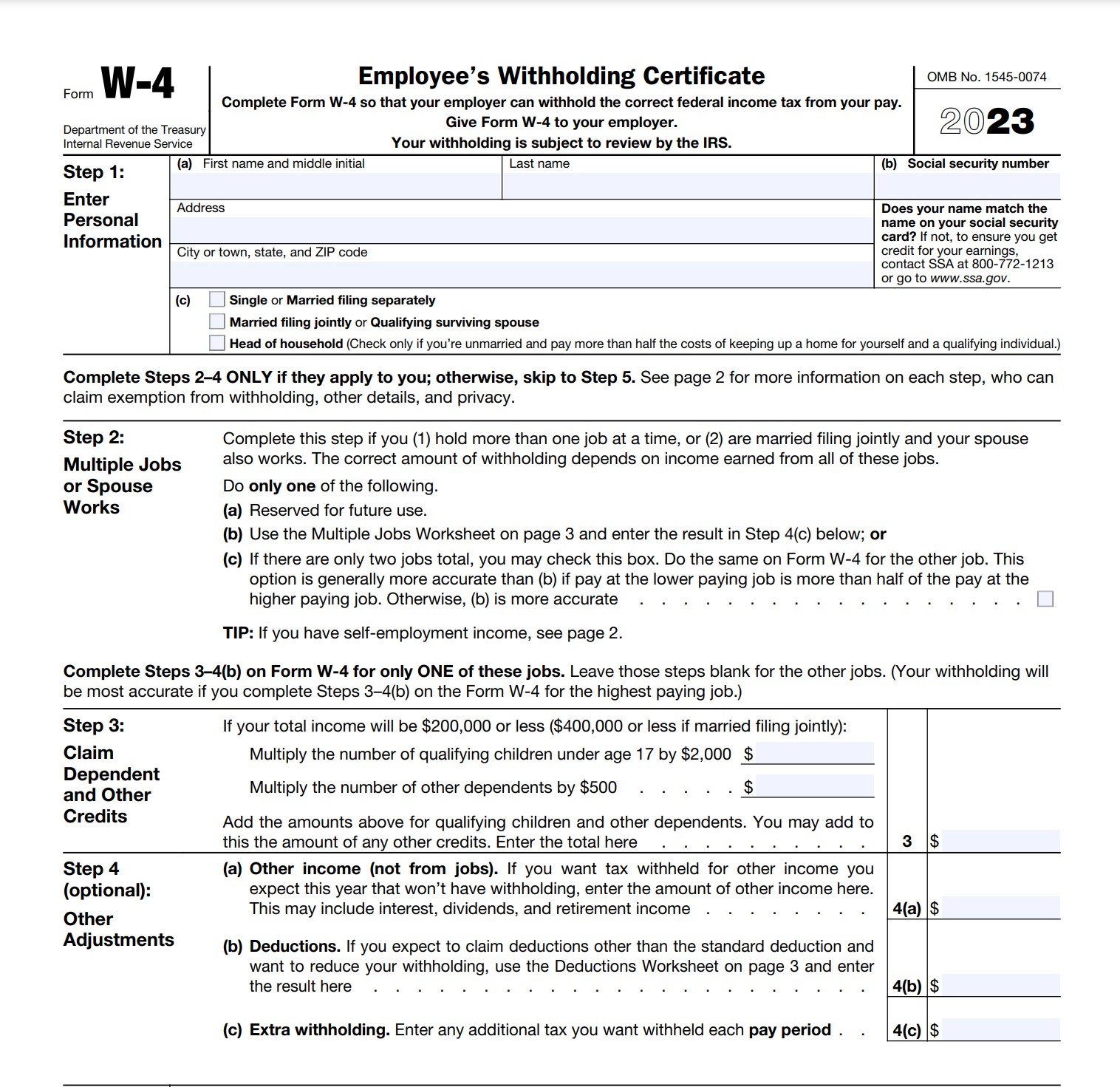

The Employee Withholding Form, or Form W-4, is an important document that employers use to determine how much federal income tax to withhold from an employee’s paycheck. The form includes personal information, such as the employee’s name, address, and Social Security number, as well as information about the employee’s dependents and other sources of income. By completing Form W-4, an employee can ensure that the correct amount of federal income tax is withheld from their paycheck.

Why is Form W-4 Important?

Form W-4 is important for both employers and employees. For employers, it ensures that the correct amount of federal income tax is withheld from an employee’s paycheck, which helps to avoid penalties and interest charges from the IRS. For employees, it ensures that they are not overpaying or underpaying their federal income taxes throughout the year, which can have a significant impact on their financial situation.

What is the Employee Withholding Form?

The Employee Withholding Form, also known as Form W-4, is a form that employees complete to inform their employers how much federal income tax should be withheld from their paychecks. The form includes information such as the employee’s filing status, number of dependents, and any additional income that the employee may have.

How to Fill Out the Employee Withholding Form

Filling out the Employee Withholding Form can be confusing, but it’s important to take the time to do it correctly. Here are the steps to follow:

- Provide your personal information: This includes your name, address, Social Security number, and filing status.

- Claim allowances: An allowance is a certain amount of money that you can subtract from your taxable income. The more allowances you claim, the less tax will be withheld from your paycheck.

- Declare additional income: If you have other sources of income, such as a side business or rental income, you’ll need to declare it on the form.

- Sign the form: You must sign and date the Employee Withholding Form to certify that the information you provided is accurate.

Changes to the Employee Withholding Form

The Employee Withholding Form has undergone some changes in recent years. In 2020, the form was updated to reflect changes in the tax code. The new form eliminated allowances and instead asks for more detailed information about income and deductions. This was done to make the withholding process more accurate and to reduce the likelihood of employees owing taxes at the end of the year.

Frequently Asked Questions

Q: What is the difference between an exemption and an allowance on Form W-4?

A: An exemption is a deduction from your taxable income, while an allowance is a credit that reduces the amount of federal income tax that is withheld from your paycheck.

Q: How often should I update my Form W-4?

A: You should update your Form W-4 whenever there is a change in your personal or financial situation. This could include getting married, having a child, or changing jobs.

Q: Can I claim zero allowances on my W-4?

A: Yes, you can claim zero allowances on your W-4 if you want to ensure that the maximum amount of federal income tax is withheld from your paycheck.

Q: Can I change my W-4 throughout the year?

A: Yes, you can change your W-4 throughout the year if your personal or financial situation changes.

Employee Withholding Form Printable

Download & Print Here: Employee Withholding Form.